Increasing Term Insurance Def

Because the sum insured decreases over time monthly premiums tend to be much lower for decreasing-term life. How does an increasing term insurance plan work.

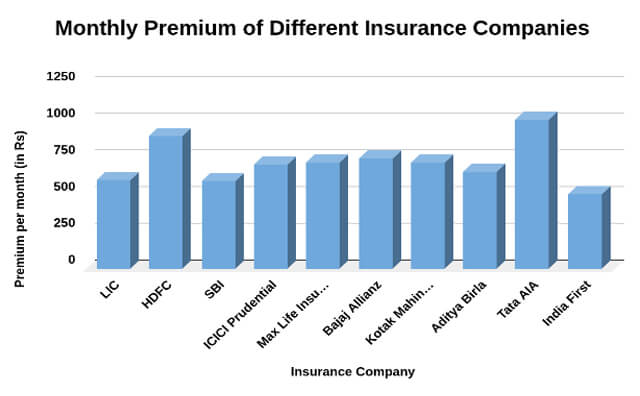

Term Insurance Compare Term Insurance Plans Online In India Aug 2021

Term life insurance or term life assurance provides a cash lump sum for your loved ones if you die within a set period.

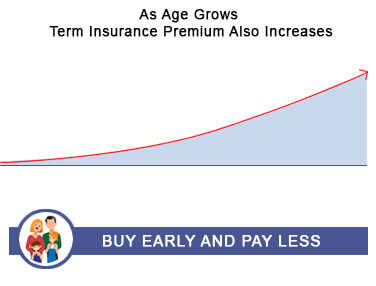

Increasing term insurance def. Increasing term insurance plan is a type of term insurance. If you pass away near the beginning of the insurance term your loved ones will receive more money than if you pass away near the end. Given the increased reinsurance costs due to the COVID-19 coverage term insurance premium increased by up to 20 from 10 th April 2020.

Term insurance plans play a crucial role in providing financial security to the policyholders family in case of eventualities. Rohan is a 30-year-old man who purchases an increasing term insurance policy with a sum assured of Rs30. Some companies passed on the burden to the policyholder but others are still evaluating the case.

The size of the payout however depends on the type of policy as well as the unique circumstances of the policy holder. The death benefit is designed to mirror the amortization schedule of a mortgage or other personal. Increasing term assurance uncountable insurance Term assurance with a sum assured that increases over the term of the contract.

Term life insurance in which the face amount of the policy increases periodically on a predetermined. Please be aware that this type of assurance is based on an assessment of the health of the applicant. Increasing term may be more expensive than other types of term life insurance though so it may not be worth it if you dont expect your needs to grow over time.

It is however not the best option for policyholders who would prefer to make the face value of their policy increase with. In case the policyholder passes away during the term plan period the insurance company will pay the sum assured as per increasing amount. Term life insurance in which the death benefit increases periodically over the policys term usually purchased as a cost of living rider to a whole life policy.

Increasing term is a type of term life insurance which means it lasts for a specific period such as 10 20 or 30 years. Find out how level decreasing and increasing term insurance works and how to get the right cover for you and your family. Coordinate terms edit.

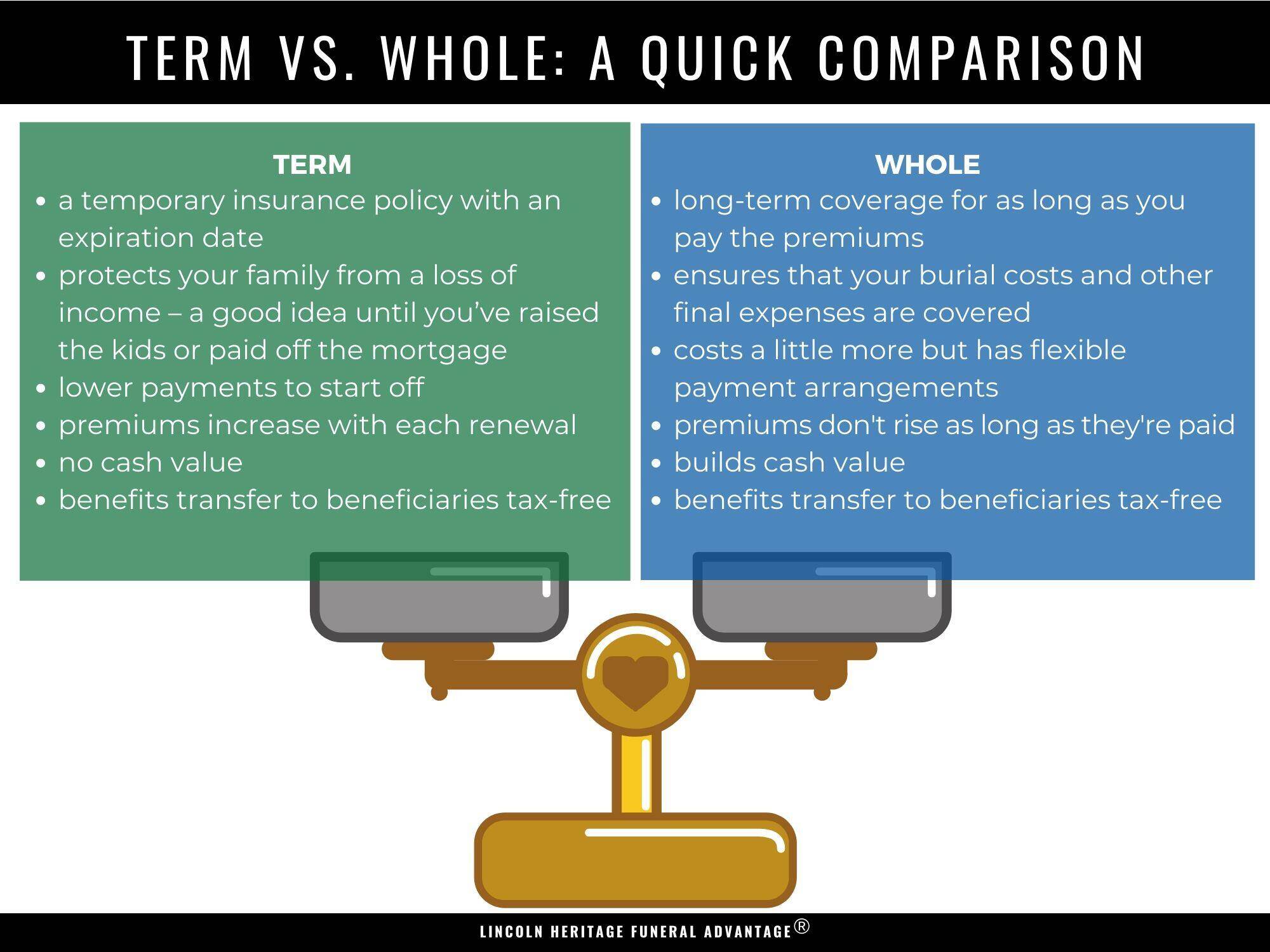

Therefore you should opt for a higher sum assured to help your family maintain their lifestyle and live a financially stress-free life. Decreasing-term life insurance is a cheaper form of policy that pays out less as time goes on. Works much like the level term insurance except that the level of cover increases - and usually the premiums too.

Increasing term insurance is typically designed keeping inflation and other changing circumstances in life in mind. Now that you have an idea about an increasing term insurance policy and how it gets adjusted to your life stages. What is Increasing term.

If you die after the term your beneficiary receives nothing. The increasing term insurance plan takes care of. Worth considering if you are insuring for a long term because increasing prices eat away at the value of a fixed level of cover.

While this is the simplest and the most basic definitions of an increasing term insurance plan the plan actually has many features which include the following. Decreasing term insurance is a more affordable option than whole life or universal life insurance. A life insurance agent can walk you through your options and help you find the right fit.

Increasing term assurance English Noun increasing term assurance uncountable insurance Term assurance with a sum assured that increases over the term of the contract. If you die during this time your beneficiary receives a death benefit from the life insurance company. Lets get to know how the policy works with the help of an example.

A life insurance policy of any kind is designed to pay out an amount of money upon the death of the policy holder. Level term insurance is a good life insurance option for people who value the stability and predictability of unvarying benefits and premiums. As the name suggests with traditional increasing term life cover amount insured increases each year by a fixed amount for the length of the policy.

Term Insurance Vs Life Insurance Differences Benefits Features

Term Insurance Compare Term Insurance Plans Online In India Aug 2021

In This Guide To Life Insurance You Will Learn Everything You Need To Know About Life Insurance Facts Best Insurance Life Insurance For Seniors

How Does Life Insurance Work Forbes Advisor

Dovno Com Business Insurance Insurance Industry Life Insurance Policy

Life Insurance Health Insurance India Whole Life Insurance Life Insurance Quotes

More On Whole Life Insurance Whatareinsurancedeductibles Life Insurance Quotes Term Life Insurance Quotes Whole Life Insurance

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Term Insurance Compare Term Insurance Plans Online In India Aug 2021

Renewable And Convertible Term Life Insurance R C Insurance Glossary Definition Irmi Com Term Life Insurance Term Life Life Insurance

Life Insurance Gender Gap Advantage Insurance Solutions In 2021 Gender Gap Life Insurance Insurance

How Does A Term Life Insurance Work Abc Of Money

Term Life Insurance Policygenius

Term Insurance Compare Term Insurance Plans Online In India Aug 2021

List Of Top 5 Best Life Insurance Companies In India On The Basis Of Life Insurance Companies Best Life Insurance Companies Health Insurance Companies

Life Insurance Over 70 How To Find The Right Coverage

Business Definition Short Term Investment Whether Home Business Ideas In Gujarati Many Home Business Id Money Management Advice Money Management Business Money

Post a Comment for "Increasing Term Insurance Def"