Increasing Term Insurance Policy Meaning

These policies come with a 5 annual increase in sum insured SI until it becomes double the original sum insured. If you die during this time your beneficiary receives a death benefit from the life insurance company.

Best Life Insurance Companies For 2021 65 Reviewed Life Insurance Companies Best Life Insurance Companies Life Insurance Quotes

Some plans have a limit to the maximum increment in.

Increasing term insurance policy meaning. With small sums of money and over brief periods of time you might not notice the effect of inflation. The recent changes to the Affordable Care Act ACA have increased the number of insured Americans and have weakened protections for those that do have insurance. This is normally in line with an agreed index such as the Consumer Price Index or at a previously determined fixed percentage.

Even though the coverage increases every year premiums under the plan. Under an Increasing Term Life Insurance plan the overall death benefit of the policy increases over time. Increasing term insurance plan is a type of term insurance.

Policy term refers to the period for which your term insurance policy will remain active. This term is determined at the time of purchasing the insurance plan. Convertible term life insurance allows a term insurance policy which has a limited number of years.

An increasing term life policy takes changes to inflation into account meaning that your payout amount rises alongside the inflation rate. In case the policyholder passes away during the term plan period the insurance company will pay the sum assured as per increasing amount. It is used to refer to the period during which the life insured is provided guaranteed coverage by the insurer.

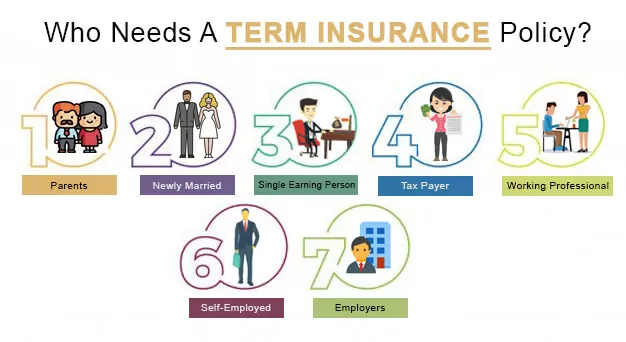

How does an increasing term insurance cover work. With increasing term life insurance your death benefit increases over the life of the policy. Types of Term Insurance Convertible Term.

What Is Decreasing Term Insurance. Increasing term is a type of term life insurance which means it lasts for a specific period such as 10 20 or 30 years. If you die after the term your beneficiary receives nothing.

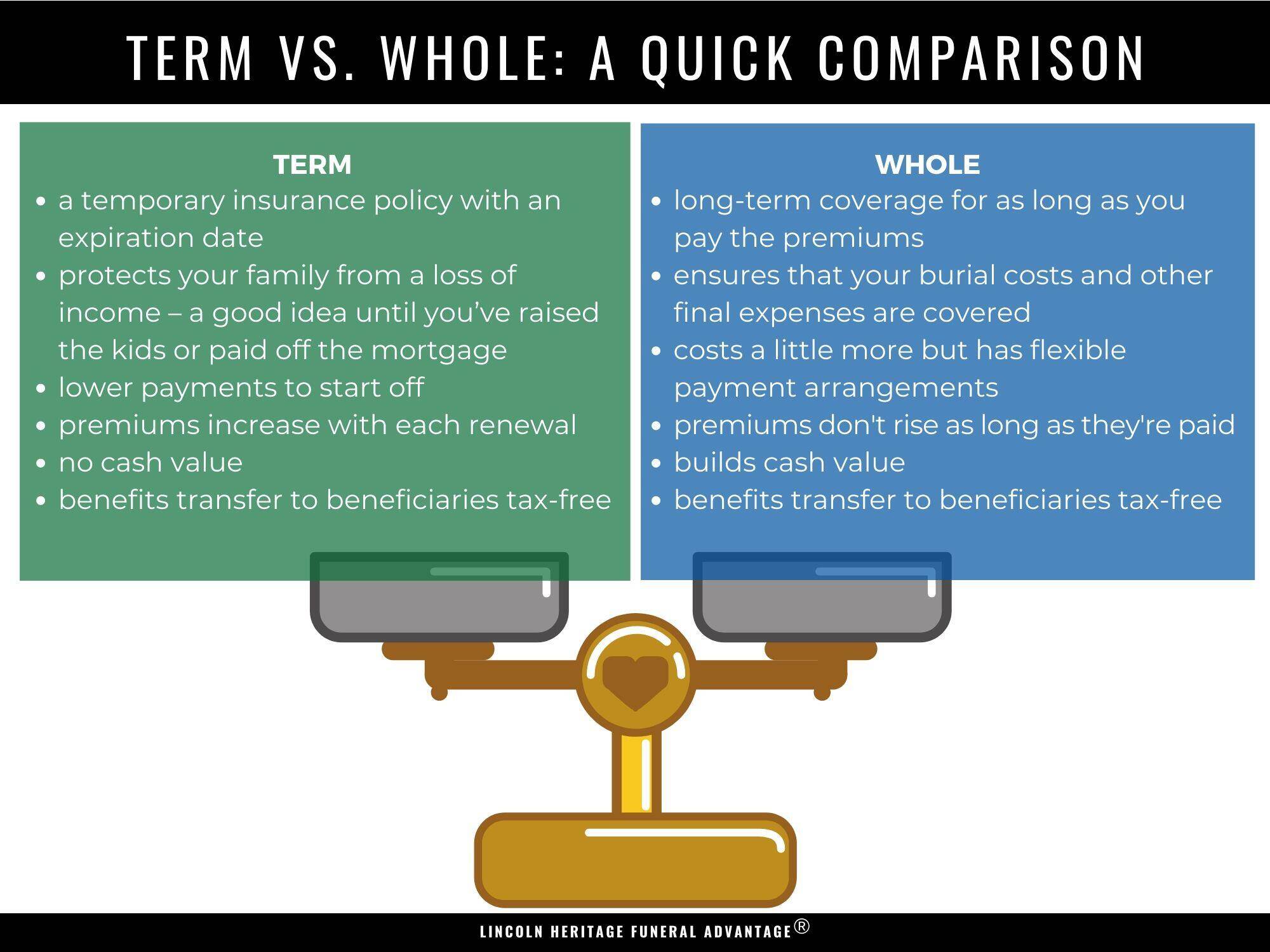

It is also possible with some companies to link the policy to Average Earnings Index AEI or by a specified percentage each year eg. A level term policy is the most common form of term life insurance and provides a set death benefit if you die while the policy is active for which you pay a premium that stays the same for the life of the policy. You may find a decreasing term policy useful if you only need your life insurance.

Some policies allow you to increase the death benefit as time goes on. Term life insurance in which the death benefit increases periodically over the policys term usuall. The sum assured as stated earlier increases every year.

What is Increasing term insurance. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. However premium-paying term refers to an altogether different concept.

For examples if the SI is 100 lakhs 1 crore in the first year it will be 105 lakhs in the second year 110 lakhs in the second year and so until it reached 200 lakhs 2 crores. Decreasing term life insurance also offers a set premium but the death benefit decreases over the life of the policy. Owners of whole life universal and other types of permanent life insurance policies may note that the policy mentions a maturity date which often coincides with their.

Term life insurance in which the face amount of the policy increases periodically on a predetermined basis. Mortgage Term or Decreasing Term. Increasing Term Assurance is an insurance policy that pays out a lump sum in the event of the death of the life assured.

This type of insurance can provide extra protection as the years go by to cover growing expenses like a new house or bigger family or protect your death benefit from inflation. The premium increases as well. The increasing term insurance plan takes care of.

What is Increasing Term Insurance Plan Coverage. Aging baby boomers and even younger folks looking to make a plan for their future may look to long-term care insurance to try and help offset the rising costs of care. Short Term Health Insurance Policies Increasing Are They Leaving Folks Unprotected and Underinsured.

Life Insurance Health Insurance India Whole Life Insurance Life Insurance Quotes

Term Life Insurance Policygenius

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Term Insurance Compare Term Insurance Plans Online In India Aug 2021

Check Out The Life Cycle Of Financial Planning Process Via Secure247trade Financial Planning Finance Saving Insurance Marketing

September Insurance Marketing Calendar Insurance Marketing Insurance Sales Marketing Calendar

Do You Have The New Type Of Life Insurance With Living Benefits Life Insurance Policy Universal Life Insurance Life Insurance Quotes

Term Insurance In 2021 Meaning Features And Advantages

Pin By Gobinath Kaliamuthu On Aia Life Planner 6012 2423349 Savings Plan How To Plan Quotations

Term Insurance Vs Life Insurance Differences Benefits Features

Pin On Outline Financial Infographic

More On Whole Life Insurance Whatareinsurancedeductibles Life Insurance Quotes Term Life Insurance Quotes Whole Life Insurance

In This Guide To Life Insurance You Will Learn Everything You Need To Know About Life Insurance Facts Best Insurance Life Insurance For Seniors

What Is Life Insurance And How Does It Work Money

Term Insurance Compare Term Insurance Plans Online In India Aug 2021

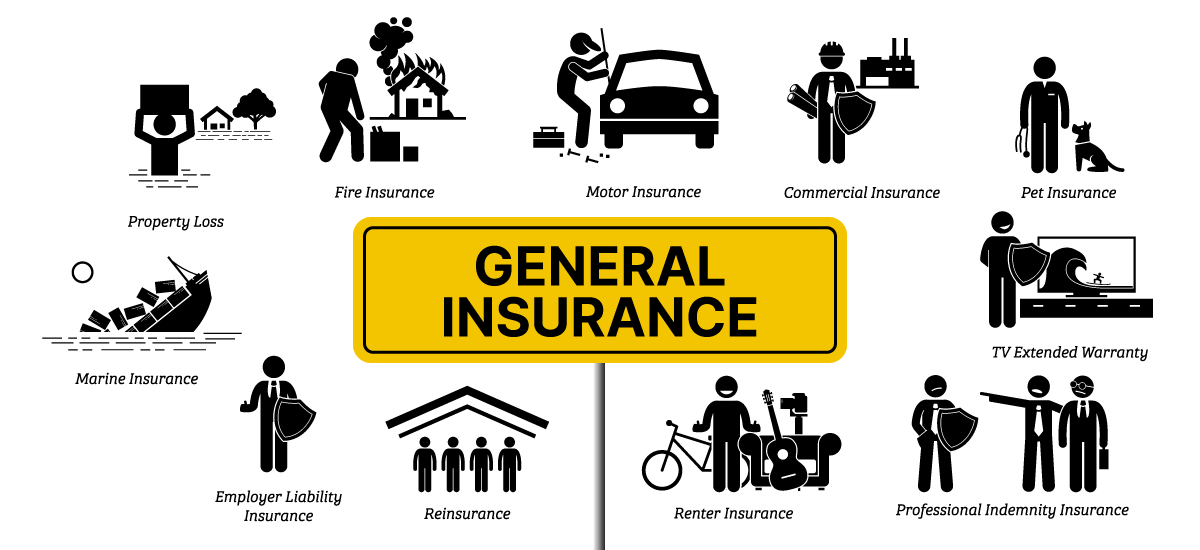

Non Life Insurance Policy Types Features And Benefits

Post a Comment for "Increasing Term Insurance Policy Meaning"